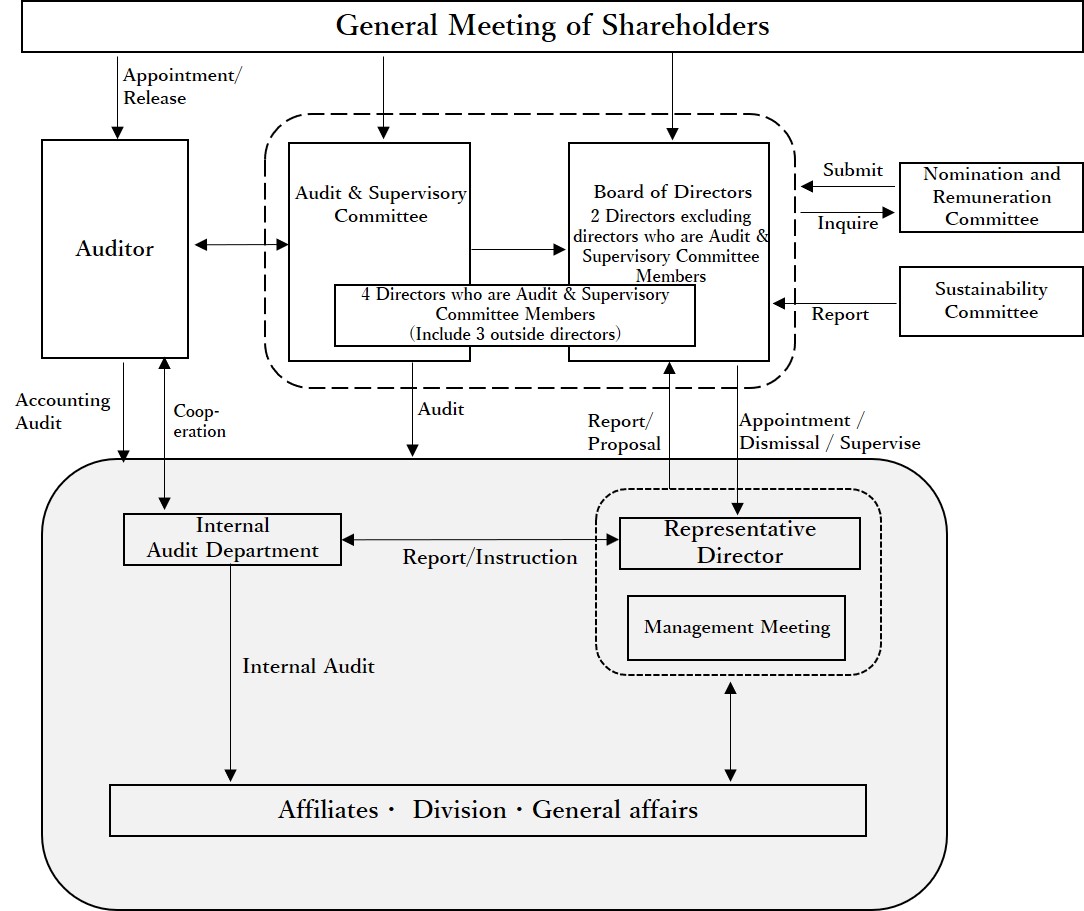

We intend to establish a system that enables quick and accurate management and executive decision-making so that we may fulfill our social responsibilities and increase our corporate value. At the same time, we strive to improve corporate governance by strengthening management oversight functions; specifically, enabling directors to more closely supervise business performance as well as encouraging directors on the audit and supervisory committees to perform legal audits.

Corporate Governance System

Corporate Governance System and Reasons for Adoption

The Company has adopted a system involving a board of directors and an audit and supervisory committee in the belief that corporate governance starts with informed judgments made by directors elected at the general meeting of shareholders who are familiar with the company’s business. The directors are engaged in mutual oversight and verification of the company’s business execution.

Institutions and Systems

The resolution adopted at the regular general meeting of shareholders held on March 25, 2016, called for a transition to an audit and supervisory committee. The company transitioned from a company with a board of auditors to a company with an audit and supervisory board. The intent of this transition was to further strengthen the corporate governance system and enhance management health and transparency.

1.Board of Directors

Our board of directors is made up of six members, including three outside directors, and decides on matters stipulated by law and important management matters, while also overseeing the directors’ execution of their duties. In order to enable the directors to quickly grasp the flow of business and make accurate decisions, they check the status of business execution even when there are no matters to be discussed at the board of directors meeting, through participation in management meetings and daily reports from the heads of business divisions. Important matters are discussed and decided at the board of directors meeting.

2.Audit and Supervisory Committee

The Company’s Audit and Supervisory Committee is composed of four directors who are Audit and Supervisory Committee members, including three outside directors. The chairperson is an outside director. The directors who are audit and supervisory committee members attend meetings of the board of directors and other important meetings, review important documents, and monitor to ensure that there are no acts in violation of laws and ordinances or improprieties. They also monitor the independence of the auditors and review the auditors’ audit methodologies.

3.Executive Officer System

In order to speed up decision making and strengthen oversight functions, the company introduced an executive officer system in April 2002 that eliminated the conflict of the same individual being responsible for both executive and oversight functions. This was a means of strengthening the function of the director.

4. Nomination and Remuneration Committee

To deliberate the appointment and remuneration of directors, enhance the supervisory function of the Board of Directors and strengthen the corporate governance system, the Company has established the Nomination and Remuneration Committee as an optional advisory body to the Board of Directors. A majority of the Nomination and Remuneration Committee members are outside directors. The chairperson is an outside director.

5.Liaison Council and Management Meetings

The Company holds management meetings whenever necessary to formulate policies and plans for the overall execution of management, as well as to carry out other research, consideration, planning, management, liaison, coordination, etc. In addition, through management meetings and daily reports from the heads of business divisions, the Company has a system in place to grasp and consider the status and problems of each business division, and to horizontally deploy responses, etc. across the entire company.

6.Sustainability Committee

The Company has established a Sustainability Committee, which is chaired by the Representative Director and President. The committee discusses policies and action plans for resolving issues related to sustainability in general and manages progress on addressing such issues. The results of the committee’s deliberations and other activities are reported to the Board of Directors and a structure for monitoring and supervision by the Board of Directors has been developed.

Directors

| Number of Directors per Corporate Charter | 15 |

|---|---|

| Term of Directors per Corporate Charter | One year |

| Presiding Officer at Board of Directors Meetings | President |

| Number of Members of Board of Directors | Six |

| Election of Directors | Elected |

| Number of Outside Directors | Three |

| Number of External Directors, Number of Directors Designated as Independent | Three |

Audit and Supervisory Committee

| Number of Members | Number of Standing Members | Number of Internal Directors | Number of External Directors | Committee Chair (presiding member) |

|---|---|---|---|---|

| Four | One | One | Three | External Directors |

Optional Committee

| Name of Committee | Number of Members | Number of Standing Members | Number of Internal Directors | Number of External Directors | Internal Employees | Other | Committee Chair (presiding) | |

|---|---|---|---|---|---|---|---|---|

|

Optional Committee Corresponding to Nominating Committee |

Nominating Committee | Four | None | One | Three | None | None | External Directors |

|

Optional Committee Corresponding to Remuneration Committee |

Remuneration Committee | Four | None | One | Three | None | None | External Directors |

Assessment of Effectiveness of Board of Directors

In order to verify on a regular basis that the board of directors is playing its role effectively and functioning properly, and to develop suitable measures for addressing problems and reinforcing strengths, the company conducts surveys of the effectiveness of the entire board of directors for each director and reports the analysis and results of the assessment to the board of directors. As a result of this analysis, the company’s board of directors has confirmed the effectiveness of the oversight of business processes and recognition of important management matters. However, the Company recognized that there are issues which still need to be addressed such as (i)enhancing discussions on sustainability and risk management and (ii) enhancement of training for Directors to develop their skills. We will continue to focus on resolving such issues in the future and will also work to improve the effectiveness of the Board of Directors and strengthen corporate governance.

Officers’ remuneration

(i) Matters related to policy for determining the amount and method of calculation of remuneration to officers

a.Policy for determining the amount and method of calculation of remuneration to officers, and composition of remuneration

The remuneration for the Company’s officers is composed of basic remuneration and a bonus. The bonus is performance-based remuneration, which is determined in consideration of results.

The basic remuneration for the Company’s officers is fixed monthly remuneration. It is determined in comprehensive consideration of the officer’s position, responsibility and years in office as well as remuneration levels at other companies, the Company’s results and the salary level of employees at the Company.

b.Matters related to determination of the ratios of basic remuneration and performance-based remuneration (bonus) to total remuneration for each officer

The Remuneration Committee (a majority of the members are outside directors) considers the breakdown of remuneration for each type of executive director in consideration of the level of remuneration at companies that belong to related business categories whose business scale is at the same level as that of the Company. The Board of Directors respects the report of the Remuneration Committee and determines remuneration for individual directors according to the composition of remuneration stated in the report.

Basic remuneration and performance-based remuneration (bonus) account for 60% and 40%, respectively, of total remuneration. (The percentages are based on the assumption that the target achievement levels related to performance-based remuneration (bonus) are all 100%.)

The Representative Director is authorized to determine remuneration for each director (excluding directors who are members of the Audit and Supervisory Committee) based on a resolution of the Board of Directors. The Representative Director has authority over the amount of basic remuneration for each director, and performance appraisal and allocation of bonuses in consideration of each director’s role and contribution, performance evaluation and KPIs (key performance indicators) achievement levels. The reason for the authority being delegated is that the Representative Director is considered to be in the best position to evaluate each director’s role by taking into account the Company’s overall performance and other factors.

Remuneration for directors who are members of the Audit and Supervisory Committee consists only of basic remuneration in consideration of their role and independence. No performance-based remuneration (bonus) is paid. Remuneration for each director who is a member of the Audit and Supervisory Committee is determined through discussion among the members of the Audit and Supervisory Committee.

c.Performance-based remuneration (bonus)

The method of calculating performance-based remuneration (bonus), etc. was determined by the resolution of the Board of Directors at a meeting held on February 19, 2021. The method of calculation is as follows:

<Method of calculating performance-based remuneration>

To raise awareness about improving results in each fiscal year, performance-based remuneration reflects performance indicators and shareholders’ perspective and is paid in cash. Performance-based remuneration changes within the range of 0% to 200% year on year according chiefly to achievement levels related to year-on-year growth in consolidated EBITDA (operating profit + depreciation and amortization), consolidated profit and consolidated ROE (return on equity) and is paid as a bonus at a certain time every year. The amount of remuneration actually paid is rounded down to the nearest 100,000 yen. The Company has selected such indicators to offer appropriate incentives with a view to enhancing corporate value on a medium- to long-term basis.

The KPIs (key performance indicators) related to performance-based remuneration and formulas for calculating performance-based remuneration are shown below.

| KPI | Formula for performance evaluation | Formula for performance-based remuneration (bonus) |

|---|---|---|

|

① Consolidated |

Result for this fiscal year / Result for last fiscal year × 60% | Annual basic remuneration according to position × Performance evaluation factor ((i) consolidated EBITDA + (ii) consolidated profit + (iii) consolidated ROE) = Performance-based remuneration (bonus) |

|

② Consolidated |

Result for this fiscal year / Result for last fiscal year × 20% | |

|

③ Consolidated |

Result for this fiscal year / Result for last fiscal year × 20% |

d.Activities of the Compensation Committee and the Board of Directors in the process of determining the amount of remuneration for officers for this fiscal year

The basic remuneration for directors (excluding directors who are audit and supervisory committee members) was consulted and decided by the Board of Directors at the Compensation Committee meeting held on March 27, 2024, and the performance-linked remuneration was consulted and decided by the Compensation Committee meeting held on February 7, 2025, after receiving their recommendations. The amount of remuneration for directors who are audit and supervisory committee members was decided at the Audit and Supervisory Committee meeting held on March 27, 2024.

e.Date of resolution about upper limits for remuneration for officers at shareholders’ meeting

At the 41st General Meeting of Shareholders held in March 2016, it was resolved that the upper limit for annual remuneration for the director (excluding directors who are members of the Audit and Supervisory Committee) is 160 million yen (excluding employee salary) and the upper limit for annual remuneration for for the director who is a member of the Audit and Supervisory Committee is 40 million yen.

(ii) Total amount of remuneration, etc. for each officer category, total amount of remuneration, etc. by type and number of officers

| Officer category | Total amount of remuneration (million yen) | Total amount by type of remuneration (million yen) | Number of eligible officers | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-based remuneration, etc. | Stock options | |||

| Director (excluding Audit & Supervisory Committee member and outside director) |

67 |

38 | 29 | – | 2 |

|

Director (Audit & Supervisory Committee member)(excluding outside director) |

7 | 7 | – | – | 2 |

| Outside director | 4 | 4 | – | – | 3 |

(Note)1. In addition to the above, the 37th General Meeting of Shareholders held on March 29, 2012 resolved to grant annual stock options worth 50 million yen maximum

2. The shareholders’ meeting has resolved to abolish the system of retirement benefits for directors (and other officers) at the close of the 37th General Meeting of Shareholders held on March 29, 2011 and pay to each Director who would remain in office after the close of the General Meeting of Shareholders retirement benefits for directors for the period in office up to the abolition of the system when they retire.

3. The number of directors (audit and supervisory committee members) (excluding outside directors) includes one person who retired at the 49th Ordinary General Meeting of Shareholders held on March 27, 2024.

Anti-social power exclusion policy

![日本セラミック株式会社 [Nippon Ceramic Co., Ltd]](https://www.nicera.co.jp/wordpress/wp-content/themes/nicera/img/logo-en.png)